Note: This is my investment advice for friends who have asked me about it. I'd like to keep this up to date as my strategy evolves. Better advice and corrections would be greatly appreciated.

Before we get into strategy, we should talk about investment accounts as some are more urgent than others. I have:

- A brokerage account

- A traditional individual retirement account (IRA)

- A Roth IRA

I always max out my IRA contributions first. IRAs have tax-advantages and limits per year for how much you can contribution to them, so every year you miss you won't be able to get back. I make these contributions at the beginning of each year to get the money into the market as soon as possible. These are retirement funds so I won't be withdrawing from them for a long time. The brokerage account is where anything else goes.

There's really only two things to my investment strategy:

- Choose low-cost index funds and ETFs (exchange-traded funds) for the your portfolio.

- Invest using Dollar Cost Averaging.

Before anything, watch this video on investment options. It's really important to understand that when it comes to your investments do your own research. You may want to have someone manage things for you. Most likely it is a scam.

This is important: my investment strategy is for the long term. The money I invest I do not intend to touch for decades. This allows me to favor higher risk investments and the flexibility in the event of an economic downturn (like when there's a pandemic) to wait until the market recovers before I pull my money out of the market.

Choose low-cost index funds and ETFs for the your portfolio

I use Vanguard to manage my index funds and ETFs. Vanguard had the lowest fees when I started using them in 2018, now Fidelity has lower fees (0%) but they achieve that by hoping you do use their more expensive products. I still use Vanguard because it's been a more ethical business. The fee I pay attention to is the expense ratio, for example VTIAX has an expense ratio of 0.11%.

With Vanguard, expense ratios are usually less than 0.10%. The index funds I have are:

| Ticker | Fund name | Expense ratio (%) |

|---|---|---|

| VFIAX | Vanguard 500 Index Fund Admiral Shares | 0.04 |

| VIMAX | Vanguard Mid-Cap Index Fund Admiral Shares | 0.05 |

| VMVAX | Vanguard Mid-Cap Value Index Fund Admiral Shares | 0.07 |

| VSIAX | Vanguard Small Cap Value Index Fund Admiral Shares | 0.07 |

| VSMAX | Vanguard Small-Cap Index Fund Admiral Shares | 0.05 |

| VTIAX | Vanguard Total International Stock Index Fund Admiral Shares | 0.11 |

| VTSAX | Vanguard Total Stock Market Index Fund Admiral Shares | 0.04 |

| VVIAX | Vanguard Value Index Fund Admiral Shares | 0.05 |

The specific funds aren't actually too important, VFIAX is my primary fund and I know a few people who have just this one fund as their portfolio. Note that some of these funds do have a minimum investment (usually $3000). If a minimum is too high, that's when you may consider buying the ETF equivalent of the fund as ETFs don't have minimum investments. My secondary fund is VGT, an ETF which I invest in because the index fund equivalent VITAX has a $100,000 minimum investment.

Invest using Dollar Cost Averaging

To summarize the strategy, ignore the market entirely. Don't try to game it, simply set up a recurring auto-deposit of some percentage of your income and put it towards your funds. Historically, the market has always gotten better over time so for long term investing you really can't go wrong with when you put money in.

The counterweight to the auto-deposit is called rebalancing. Basically over time, the ratio of funds that make up your portfolio may not match your risk tolerance. For example, having a majority your money in a few funds will feel quite risky. You will want to rebalance (redistribute) that money to many funds or more evenly between the funds so that you aren't dependent so strongly on a single fund. I rebalance every six months. My approach is to edit the auto-deposit to fill underserved funds to bring them into line.

[Bonus] COVID-19 effect on my investments

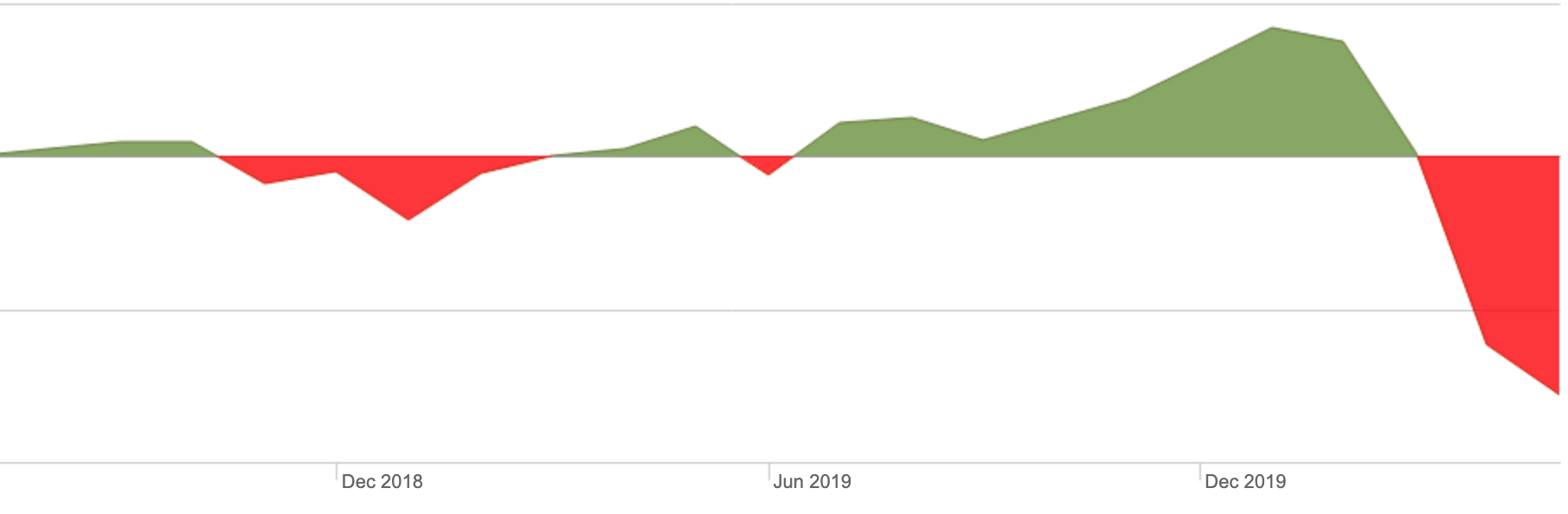

If you want to see what investment returns look like right now due to COVID-19 (April 2020):

While you generally want to buy when the market is low, this drop is unprecedented in that the economic decline is completely normal. The drops of 2000 and 2008 were due to misinformation and market distortions so the market could recover more quickly. It will take a long time for markets to recover from the pandemic and it is not clear we've hit bottom yet.

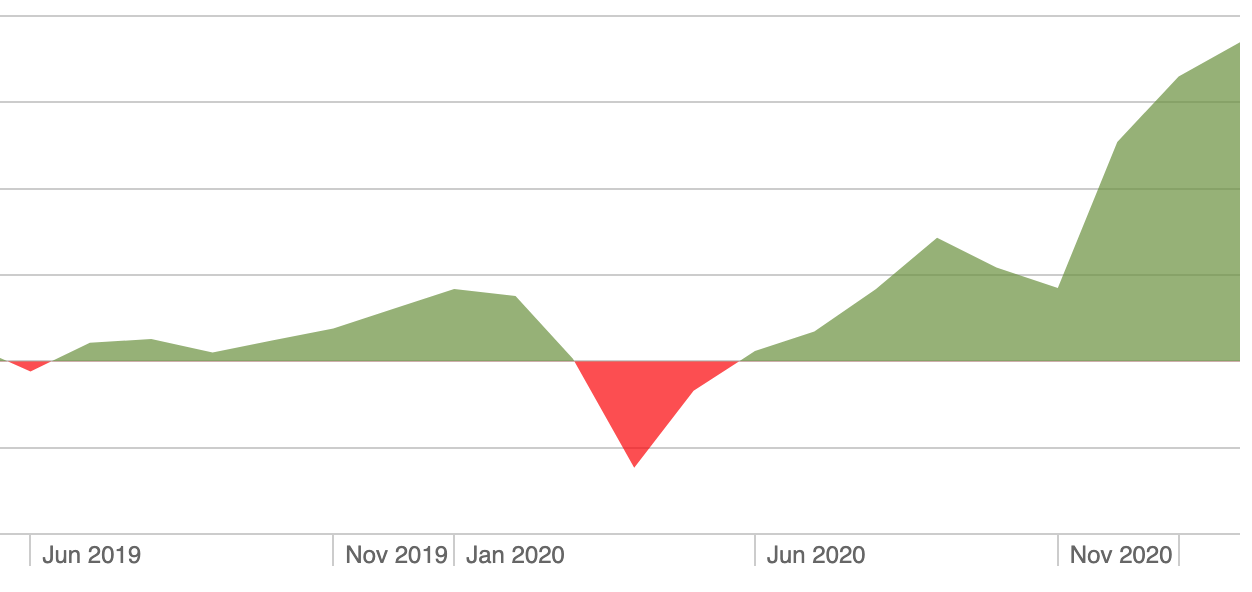

Even so, my auto-deposit is still active. I'm in it for the long term so this doesn't really effect me. Eventually, the market will recover. [Update] It did recover (end of 2020):

That's basically all there is to my investment strategy. Do your own research for what makes sense for you.